Trading at the Speed of Now: How Kubernetes Powers Real-Time Insights & Rapid Agility in Financial Markets

In the fast-paced world of financial trading — where microseconds can make or break a deal — the reliance on legacy application architecture poses a critical challenge for trading firms. These firms navigate an intricate landscape where swift execution, real-time risk analysis, and scalability are not only competitive advantages but also the bedrock of success. However, the latency of outdated systems can hinder their ability to respond to dynamic market shifts and analyze risk in real-time.

These risks stem from the limitations of outdated infrastructure designed for a different era. One of the most pressing risks is the inability to keep pace with the demands of real-time trading. Legacy batch processing systems, originally developed for end-of-day operations, struggle to provide the instantaneous execution and response times that today’s markets demand. As a result, trading firms may miss opportunities due to delays in order execution, affecting profitability and market standing.

Additionally, these aging systems often lack the agility to adapt to sudden market shifts or portfolio balance changes, leaving firms vulnerable to compliance breaches and financial losses. The accumulation of technical debt over the years can also lead to higher administrative costs, increased downtime for maintenance and upgrades, and an overall lack of scalability to meet growing real-time analysis needs. Ultimately, these risks translate into compromised business outcomes, diminished competitiveness, and the inability to capitalize on emerging trends in the financial industry.

Modernizing batch processing to a Kubernetes and microservices architecture can provide several benefits. Kubernetes brings a twofold agility to intraday trading. When properly architected, containerized workloads can scale horizontally to run multiple workloads at once. This capability allows data processing to run concurrently and conduct multiple analyses in near real-time.

Accelerate your path to modernization with Kubernetes on AWS

Effectual has successfully partnered with financial services customers to accelerate their modernization to a scalable, real-time platform leveraging Kubernetes on AWS. This modernization has enabled organizations to trade quicker and assess risk in real-time, leading to better-informed decisions and data-driven insights. The result is increased productivity, reduced risk, and faster executions.

Follow a customized roadmap to match specific modernization goals

Effectual helps navigate the path to modernization with a methodology beginning with an application modernization maturity assessment. To remain at the forefront of the financial market, trading firms must periodically assess their existing technology environment. However, technology is not the only consideration in this phase. Effectual completes a comprehensive review of how the customer operates from a people and process perspective. Without clearly defining the desired business outcomes, skill sets, and culture of the daily processes, the technology tells an incomplete story.

By understanding the way various business units interact and the reasons the technology was architected in its current form, Effectual can tailor a technical roadmap and change management strategy to transform the organization — both from a digital and cultural standpoint.

Align technical infrastructure with market dynamics

After the maturity assessment is completed, Effectual establishes platform engineering tenets like abstraction, simplification, automation, and feedback loops into an organization’s modernization strategy. Adopting advanced methodologies such as infrastructure as code and Kubernetes is crucial to streamline and automate infrastructure management. By aligning their technical infrastructure with market dynamics, trading firms can guarantee their operations are always in tune with current trends and shifts.

Migrate and synchronize data to a modern cloud system

Once the platform and future workload state are defined, the migration of data to a dual environment between legacy and modern cloud systems is step one. In the ever-evolving financial landscape, safeguarding data integrity is vital. By simultaneously housing data on both legacy systems and cloud storage, firms can confirm trading continuity, even during transitions. This dual environment offers the assurance and reliability traders need to ensure every investment and trade is executed on accurate, up-to-date information.

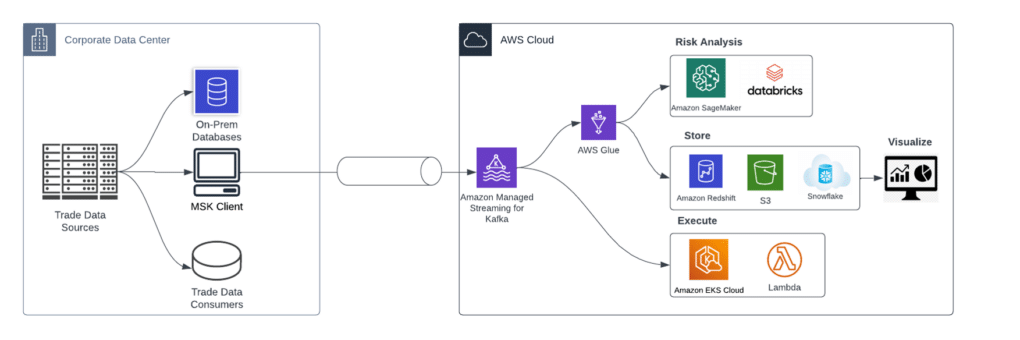

Effectual’s methodology for data synchronization is to leverage Kafka — specifically, Amazon Managed Streaming for Kafka (MSK) — when modernizing on the AWS cloud. MSK is a fully managed service that enables you to build and run applications using Apache Kafka to process streaming data. Once the data exists in both legacy systems and modern cloud storage, it is controlled across the systems with a cloud-based messaging architecture. By minimizing data latency, financial institutions can accelerate trades, acting on insights quicker than before.

Below is a high-level architecture depicting trade data sources as the “producers” of the data and various AWS and independent software vendor (ISV) technologies as the “consumers” of the data. Note how MSK allows an institution to simultaneously analyze risk, visualize data, and execute business logic.

As the financial industry evolves, so too must the tools used within it. With new services tailored for today’s platforms, trading firms can ensure they remain at the industry’s cutting edge. This forward-thinking approach allows them to continuously innovate, offering traders the best tools and insights to stay ahead of the curve.

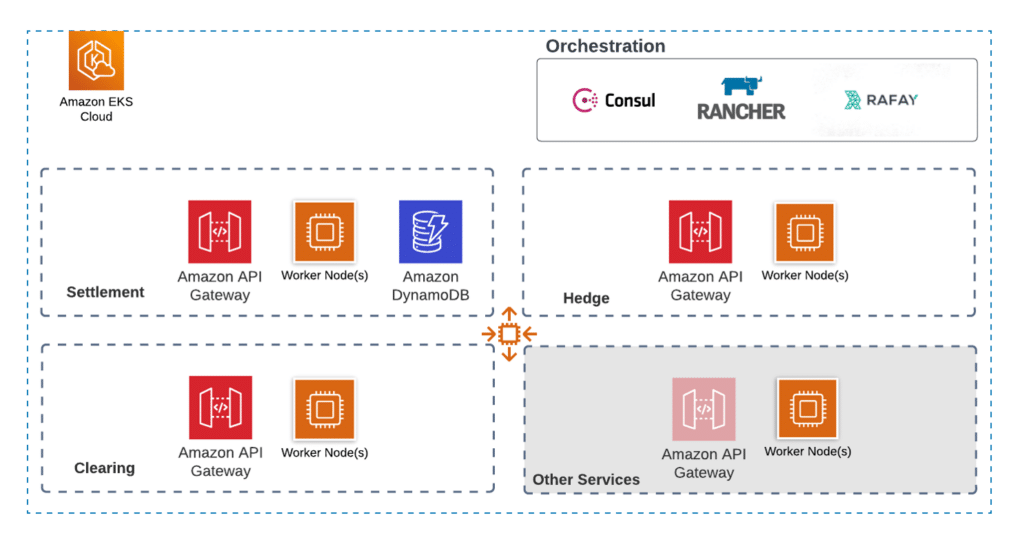

The integration of a Kubernetes platform offers unparalleled scalability and responsiveness of business logic. As financial firms shift their applications to this platform, they benefit from its self-healing and auto-scaling capabilities, enabling traders to always have real-time access to critical systems and bolstering their market positioning.

Utilizing Kubernetes in this manner empowers your product development and platform teams to improve productivity through automation and observability. As the platform shifts through continuous integration (CI) and continuous delivery (CD), security scanning tooling, etc., the time to market with new features is accelerated, while a secure and compliant posture is maintained.

Further decoupling applications by employing Kubernetes and Kafka will modernize the applications to event-driven microservices. The benefits include, but are not limited to, a reduction in blast radius at change event times, fewer performance bottlenecks in application hot spots, and multi-threading business operations.

Below is another high-level architecture showing an expanded view of an Amazon Elastic Kubernetes Service (EKS) cluster. Note the flexibility of orchestration tools paired with Kubernetes’ ability to auto-scale and simultaneously execute business logic for settlement, hedge, and clearing — all harnessing the same data.

As the financial landscape continues to shift, ongoing adaptation becomes a necessity. With new technologies evolving daily, it is essential to remain current and modern to stay ahead of the competition.

To determine the best modernization strategy for your organization, contact Effectual and begin your journey by partnering with us.

Follow us on LinkedIn.

- Author: Effectual

- CATEGORIES: Finance

Share the Post:

Related Posts

GET STARTED